Congratulations if you own a food & beverage business with 5 or more employees, You’ve built your business to be amongst the top 12% highest performing businesses in Australia.

In an ever-more volatile trading environment with more opportunities than ever, as well as the danger of being wiped out through simply not moving forward, your challenge is to accelerate growth of both profit and business value.

Your management reports make it easy to track changes in profit. And your returns on this investment are the salary you draw from the business plus the profit in the form of dividends. Statistically, most business owners draw less from their own businesses that they would with a much lower level of risk (and stress) as an employee elsewhere.

So why do it? As well as the qualitative aspects of freedom, contribution and the capacity to take control of your own life, it’s the business value you build up in the business.

Market Value

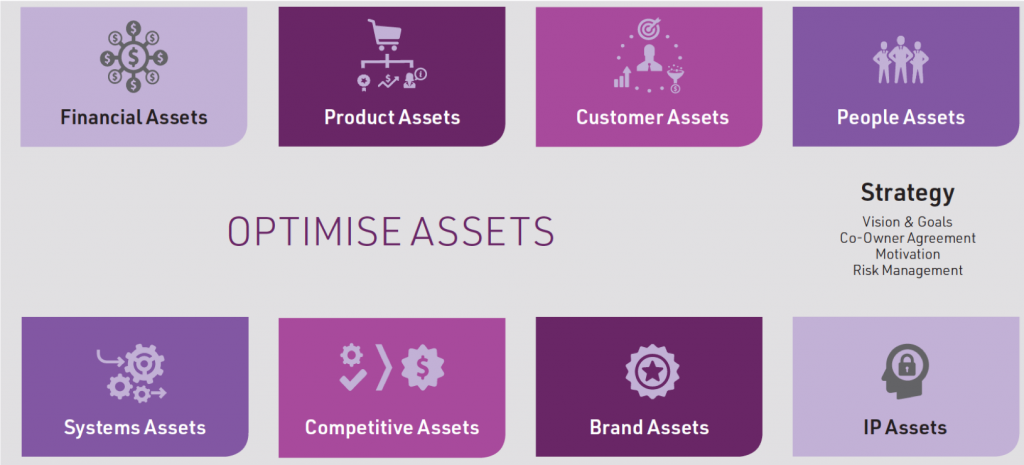

There’s two components to market value. Firstly, the value of those assets. This is based on their ability to generate profit and future growth. There are eight key assets that drive all food & beverage businesses

Secondly, it’s the value of those assets to a future potential buyer of your business, and they will value your business based not just on the cash flow generating assets of your business in isolation, but that how those assets can benefit the value of their existing business.

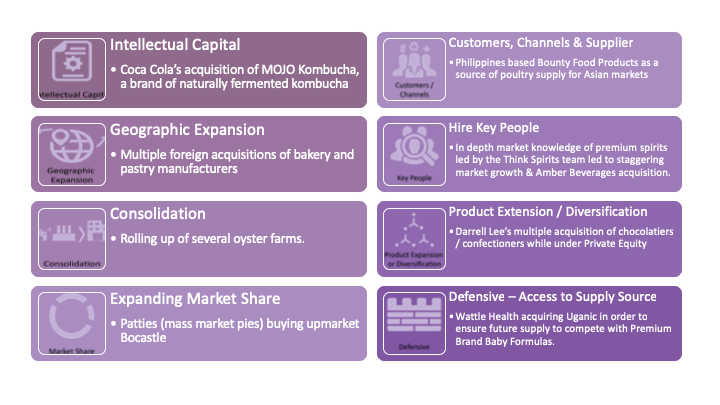

At Strategic Transactions, we’ve reviewed all available acquisitions of food & beverage businesses over the past three years and listed the main acquirer motives when buying a food & beverage business.

The average market value of a mid-sized F&B business is still increasing (as a multiple of profit) once the business reaches a critical size. Acquirer interest in food & beverage remains high as Australian food & beverage is seen as a strategic quality assetBut there are storm clouds over the horizon, with decreasing values forecasted due to excess supply of sellable businesses (thanks to retiring baby boomers), a lower cost to recreate and launch a business. (look at all the online direct distribution food offerings) and the challenges of a business remaining relevant with rapidly changing consumer tastes.

So with this in mind, here’s some tips for working “on” rather than “in” your food & beverage business.

1. Think about who would buy your business and why. (even if you’re not selling!)

Have one eye on who would buy your business. One day we all have to exit and regardless of whether you list on ASX, make a trade sale or pass it onto family or employees, value is a key consideration. Think about what the buyers’ motives would be in acquiring your business.

2. Maintain communications with the outside world.

Consult widely. It can be lonely being a biz owner. Some of the more traditional networking opportunities like chambers of commerce and industry associations have been technologically superseded by digital resources. It’s easier than ever to get data and fact sheets, but harder than ever to get gut-feelings instincts and find out what really goes on in peoples’ minds. The most successful entrepreneurs are those that interact with others. Deepak Chopra said that though we have approximately 60,000 thoughts in a day, “95% of them are thoughts we had the day before.”

You can also join clubs where fellow members share a similar mindset or challenges to yourself. I’m part of the Key Person of Influence network because I want to work with influencers in our respective industries. I also want to stay in touch with best practice in turning around the fortunes of struggling businesses (Australian Transformation & Turnaround Association), while the association for my profession the AIBB lobbies government keeps me informed of legislative changes in my industry.

My own business Strategic Transactions works with 50 collaborative partners and experts in their specific field who advise on everything from Intellectual Property to doing good in society.

3. Efficiently track the global competitive evolution of the industry

Waves of disruption are continually threatening the value proposition of many food producers. Track global innovation. In the sub-sector. Plenty of resources to do that – reference for example some of the spectacular foresight work of CB Insights. Part of our client planning is to build on the Porters Five Forces model to see what competitive dynamics, opportunities and threats may be applicable over the next 5-10 years.

Sometimes you need to roleplay the outsider looking in. John Culkin once said, “we don’t know who discovered water, but we’re certain it wasn’t a fish”.

A wide range of issues will substantially impact the competitiveness of a food & beverage business. These include: production sustainability, shifts in diet of middle-class Asians, the movement to protein based diets, food safety & handling practices, wellness and healthy ageing, premium convenience foods, direct to consumer distribution, sugar reduction technologies, blockchain based supply chains, beauty boosting foods and sustainable packaging.

4. Do good

Socially aware businesses that care about the broader society and environment substantially outperform those not socially aware with key profit indicators.

Become a business that “does good.” Look at all of the environmental and social challenges that we are all faced with and decide how we can all play our part. ForPurposeCo. is a profit-for-purpose social enterprise focusing on investment in food and waste technology and innovation recently launched “Juice for Good.” ForPurposeCo take some of the 50% of Australian grown oranges don’t make it to the supermarket shelves and installed them in vending machines.

Look at umbrella organisations such as B1G1 that can help make your business a force for good by embedding giving right at the core of what you do.

5. Drill down at your financials

They say there are three types of entrepreneurs. Those that are good at numbers and those that aren’t.

Take a good look at your numbers. My business recently consulted with food business that increased its market value by 112% simply by increasing price by 9% in market value. Owners can’t improve what you can’t measure. Importantly, benchmark the value of your business.

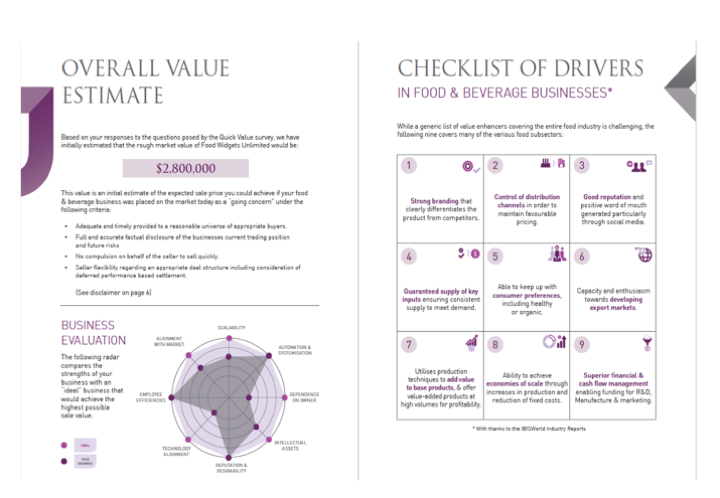

Strategic Transactions offer a free online scorecard for estimating the market value of your Food & Beverage business, accessible here. The questions also highlight the strengths and weaknesses of your business and provide you with a roadmap for increasing value.

Once you’ve benchmarked this value, you can build strategies and measure the impact of these strategies on value through a wide range of financial tools. These focus on macros such as forecasted cash flows / valuation estimates (Futrli , Jazoodle) or drill down to a micro-level with non-Excel or Excel based tools such as Modano that enable you to analyse optimal channel mixes, product mixes, customer concentration, loyalty and recurring revenues.

6. Utilise your people effectively.

If you put fences around people you get sheep. Numerous academic organisational behaviourists have concluded that people who are cared for, care more and this is a far greater motivator than salary. It’s in the owners’ advantage to create a rich environment in the workforce where their respective skill sets can be fully utilised, and their morale, momentum and retention can be improved.

Can you take off on a cruise this year? A business is much more valuable if there’s continuity without the owner as rainmaker. So, in 2019 think about whether your personal involvement is positive to long term value and consider how productivity can be enhanced without creating undue reliance on key employees.

Finally, employment law can be a minefield and the costs and legal consequences of getting wrong can potentially be overwhelming. Experts such as Employee Matters are able to audit your current set up and pre-empt any omissions or challenges.

7. Branding is key to identity and competitive edge

Think about the importance of branding particularly in an age of home brand. Much of the value in the lucrative sale of Harry’s Café de Wheels was the iconic brand and the consequent opportunities for it to expand. The new owner Tino Dees admitted he’d paid too much but “Because of the plans we have in place for Harry’s, however, that number becomes irrelevant”

8. It’s more than just about work

Remember your other personal & financial goals. Goes back to the old adage of whether you find self-actualisation in your work, whether money can buy love, health and time with family. One of the greatest challenges I find with owners their fear of their own value post-work. As a related topic think about whether the money you earn and the value you create is working for you effectively. If your business is returning you less than x% p.a., you might be better off trading the ASX in your P.J.’s instead!

Ultimately, we all have to weigh up the relative importance of issues such as work, love, family, health, fitness, education, pleasure, community and (for some) faith.

This is just eight of the hundreds of ways that food & beverage business owners could work “on” their businesses in order to improve the value. The list goes to hundreds: stay creative, improve business systemisation, but ultimately it boils down to the available time you have available and your priorities.

About the Author

Mark Ostryn, is the director of Strategic Transactions. Strategic Transactions helps small and mid-sized food & beverage businesses maximise their value.This is regardless of whether it’s the owners intention is to sell their business this year, in 5 years or not at all.

Mark has authored and coordinates a mentoring programme for food entrepreneurs designed to triple the value of their business. He is also the author of the forthcoming book, “Selling a Business that Buyers Really Value”, the business owners guide to a lucrative exit deal.