Our analysis of several hundred Australian business transactions has found that the following fifteen factors affect sale values the most. Use Quick Value to test the value of your business.

1. THE INDUSTRY: Certain industries exceed others in sale multiple values Also the variability of sales value within an industry can be significant. For example, in tech, cloud technologies are more valuable than computer retailers. Test yours here.

2. TURNOVER: The larger the revenue of the business, the higher the multiple.

3. PROFIT: The higher the ratio of profit to revenue, the more efficient and productive the business.

4. HISTORIC & FORECAST PROFIT: If profit is currently growing and buyers expect that trend to continue or even accelerate then value will be higher.

5. LEVEL OF AUTOMATION: The extent to which automation efficiencies in areas such as stock control, financial systems, online sales and a CRM contribute to greater competitive advantage.

6. PREPAREDNESS FOR TECHNOLOGICAL CHANGE: Rising the crest of the wave of technological change makes businesses more futureproof, therefore more valuable. Think of printed newspapers and coal.

7. RECURRING REVENUES: The more that revenues can be predicted in advance through subscription, contracts, repeating customers, licences and annuities, the higher the value.

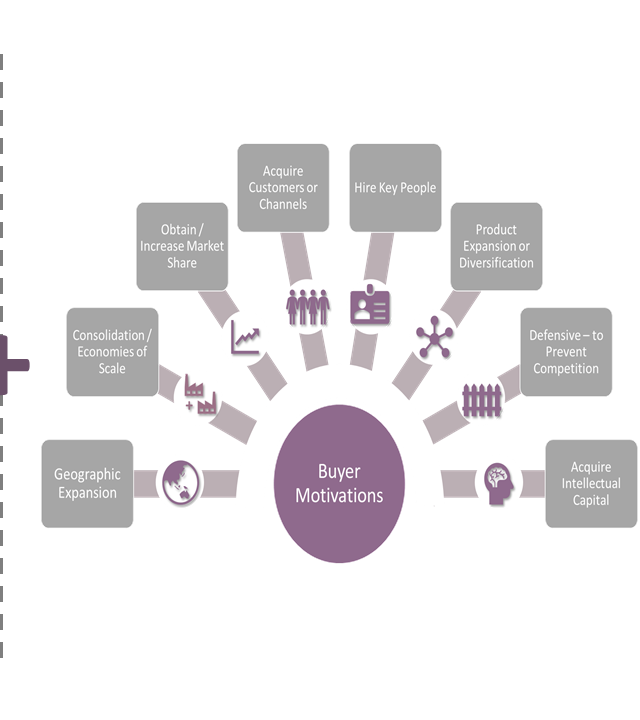

8. ATTRACTIVENESS TO LARGER ACQUIRERS: The more attractive that more than one larger business finds the target business, the higher the value. Buyer heat determines value!

9. PERIOD PRIOR TO SALE: The less desperate the owner is to sell, and the more inclined the owner is to stay on to increase the attractiveness of the business, the higher the value.

10. SCALBILITY: The more likely the business can respond to a capital injection with increasing returns (ROI) to investors, the higher the value.

11. MONOPOLIST: The extent to which a business can dictate price and that there aren’t many current or expected competitors because of entry barriers, the more valuable.

12. INTELLECTUAL PROPERTY: If the business owns IP that can spearhead its future growth into new products and services then it becomes more valuable.

13. CUSTOMER CONCENTRATION: The less that a business is dependent on a few key customers that could take their business elsewhere at any point, the higher the business value.

14. OWNER INDEPENDENCE: If the business has a suitably skilled and motivated management team operating independent of the owner, it is more valuable.

15. PRODUCT PIPELINE:If the business has a guiding vision, clear objectives and a pipeline of future products to launch, it becomes more valuable.

Quick Value makes a rapid assessment of businesses value and can be accessed HERE

Quick Value is free of charge and confidential and has been developed for business owners and their advisors. The Quick Value algorithm has been developed by Strategic Transactions. Mark Ostryn is the Founding Director of Strategic Transactions, Sydney-based M&A consultants specialising in valuations, exit planning and business sales.