Business owners spend years and risk everything to build businesses with value.

It’s our goal and responsibility to make sure that our owner clients exit their business at the best possible value and terms.

Strategic Transactions are committed to work tirelessly and tenaciously to achieve that goal.

Our Commitment

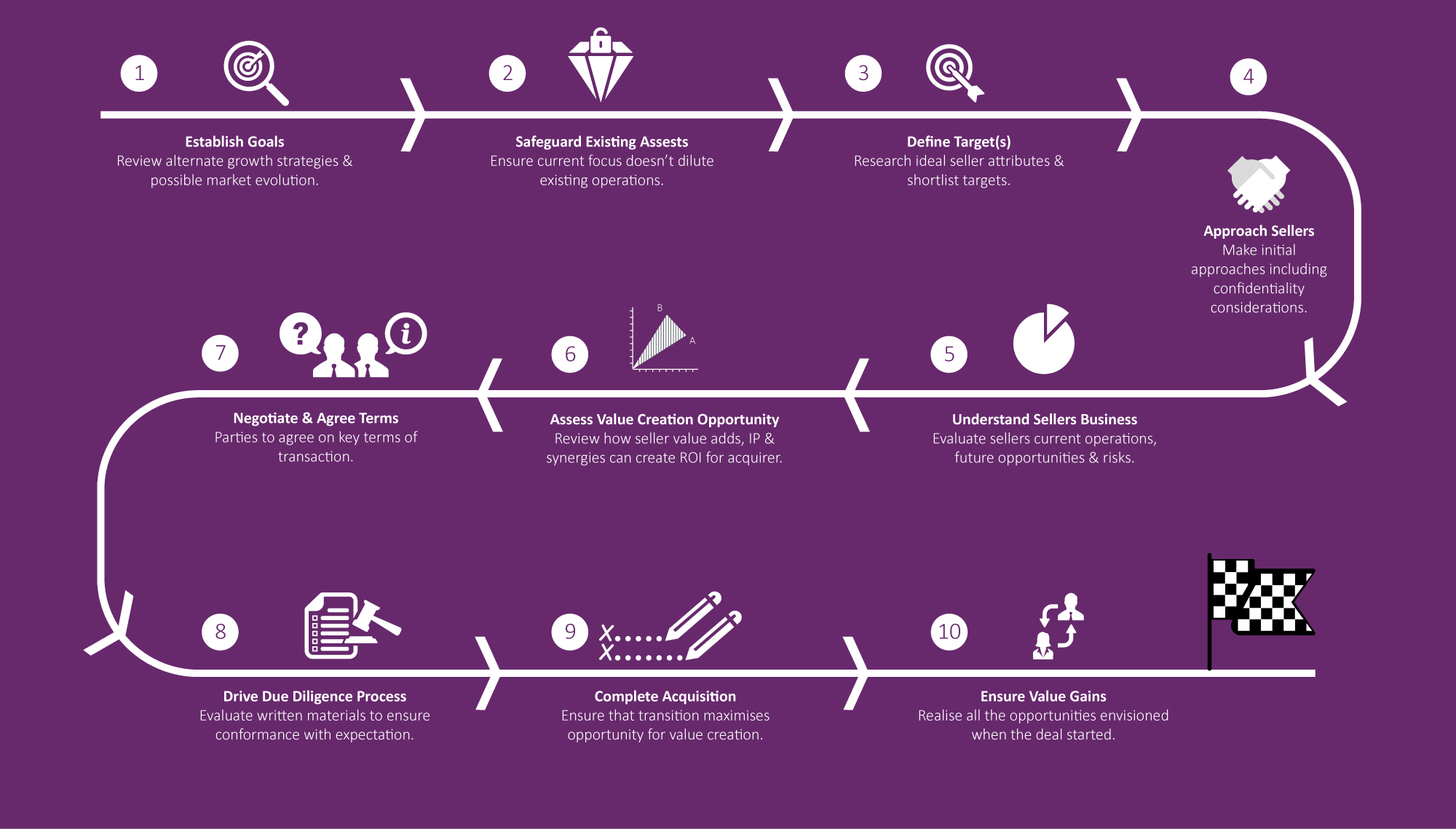

Ten Step Acquisition Process

Strategic Transactions guide our clients through each stage of the acquisition process, ensuring that personnel are included and collaborate at all relevant points. This keeps delays, uncertainties and costs minimised.

Strategic Transactions have a proven project management methodology for scheduling critical activities. Generally it can be broken down as follows:

1

Transaction Stage

Review alternate growth strategies & possible market evolution.

Action

- Clarify overall company objectives and best means of achieving them – in particular can acquisition goal be achieved by other means – alliance, JV, reinvestment of cash flows?

- Encourage consensus for those objectives amongst co-owners.

2

Transaction Stage

Ensure current focus doesn’t dilute exisiting operations.

Action

- Ensure that planned transaction doesn’t shift from growth focus, operational continuity and continual improvement.

- Minimise disruption to existing operations.

- Appoint acquisition team. Consider appropriate internal & external personnel to guide the process.

- Consider issues relating to confidentiality of process and outcome.

3

Transaction Stage

Research ideal seller attributes & shortlist targets.

Action

- Assess criteria such as company size, structure, profitability, potential, technology and customer characteristics, appetite for risk.

- Approve an appropriate budget for acquisition and means of financing it.

- Gather industry intelligence on niches.

4

Transaction Stage

Make initial approaches including confidentiality considerations.

Action

- Weigh up advantages of direct approaches.

- Meet prospective sellers, maintaining a vigilant eye for what is observed as well as what is said.

5

Transaction Stage

Evaluate sellers current operations, future opportunities & risks.

Action

- Be prepared to more deeply question seller responses to issues that require clarification.

- Understands sellers’ current situation, future competitiveness, opportunities and risks.

6

Transaction Stage

Review how sellers value adds, IP & synergies can create ROI for acquirer.

Action

- Review likely return on investment for merged operation. Consider market opportunity and growth prospects as well as key risks and their mitigation.

- Undertake quantitative analysis. Create financial models using sensitivity and scenario analysis under alternate deal structures.

7

Transaction Stage

Parties to agree on key terms of transaction.

Action

- Obtain enthusiasm and enthusiasm from shareholders and other parties.

- Consider most appropriate method for sourcing acquisition funds.

- Negotiate term sheets deciding on heads of agreement as a basis for undertaking due diligence.

8

Transaction Stage

Evaluate written materials to ensure conformance with expectation.

Action

- Review all key documents for due diligence, specifically: strategic, financial, ownership and structure, employee, customer records, sales & marketing, technology, R&D, plant & equipment and legal.

- Be prepared to seek clarification on unclear issues.

- Be prepared to renegotiate based on findings.

9

Transaction Stage

Ensure transition maximises opportunity for value creation.

Action

- Sign all appropriate agreement, particularly in relation to sale of assets / company, leases, intellectual property, licenses and post-sale consulting.

- Communicate with key stakeholder partners to ensure a smooth transfer of documents, personnel and locations.

10

Transaction Stage

Realise all the opportunities envisioned when the deal started.

Action

- Bring to fruition all of the opportunities envisaged when the acquisition process first started.

- Ensure activation of ongoing business plan, key personnel are motivated and a progress review cycle is implemented.

Our Value Add

- We work with mid-sized businesses, particularly in the food and beverage, medical & cosmetic and technology sectors.

- We understand the perspectives of business sellers and are able to negotiate with them in a commercially empathetic process to ensure value is retained.

- We will help you evaluate a broader range of growth alternatives. While vertical, horizontal or geographical acquisitions may be appropriate, certain goals can be achieved through a simple JV, partnership or alliance.

- We we are delighted to work with you over a longer period to refine your operations and growth path. This will result in you achieving a higher value. Our Value Discovery services will close the gap between the current value of your business and your value goal.

- We will work alongside your legal and financial team, helping you navigate through complex deal structuring, to ensure that your business achieves maximum growth and profitability.